Student loan forgiveness

In order to receive forgiveness most federal student loan borrowers whose income qualifies will need to submit an application form detailing their income. To be eligible for Canada Student Loan forgiveness you must have.

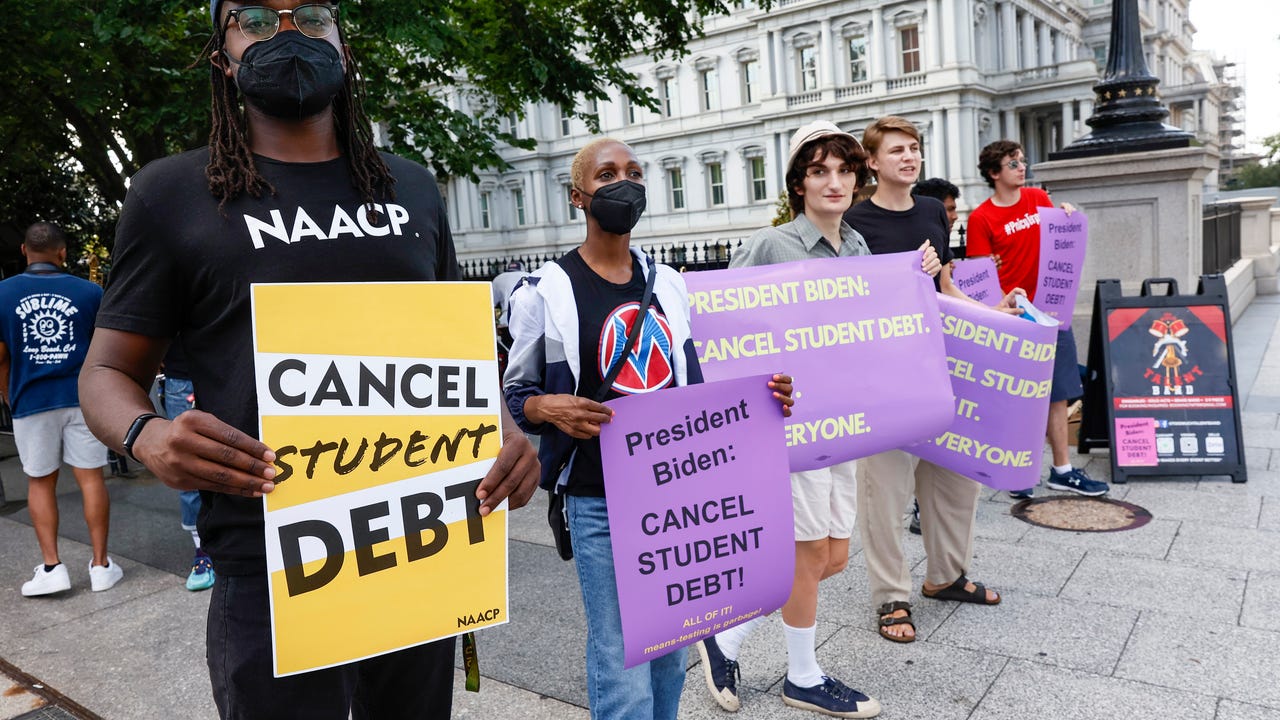

Can Biden Cancel Student Loan Debt These States Say No Here S Why

Started your current employment full-time part-time or casual as an eligible medical professional family.

. Federal Student Aid. A Texas-based federal court ruled on Thursday that Bidens sweeping student loan forgiveness plan is illegal. Up to 20000 if they received a Pell Grant which is a type of aid.

So if you earned 120000 in 2020 but got a big raise in 2021 you still qualify. People with existing federal student loans who earn less than 125000 a year are eligible for forgiveness. Forgive loan balances after 10 years of payments instead of 20 years for borrowers with original loan balances of 12000 or less.

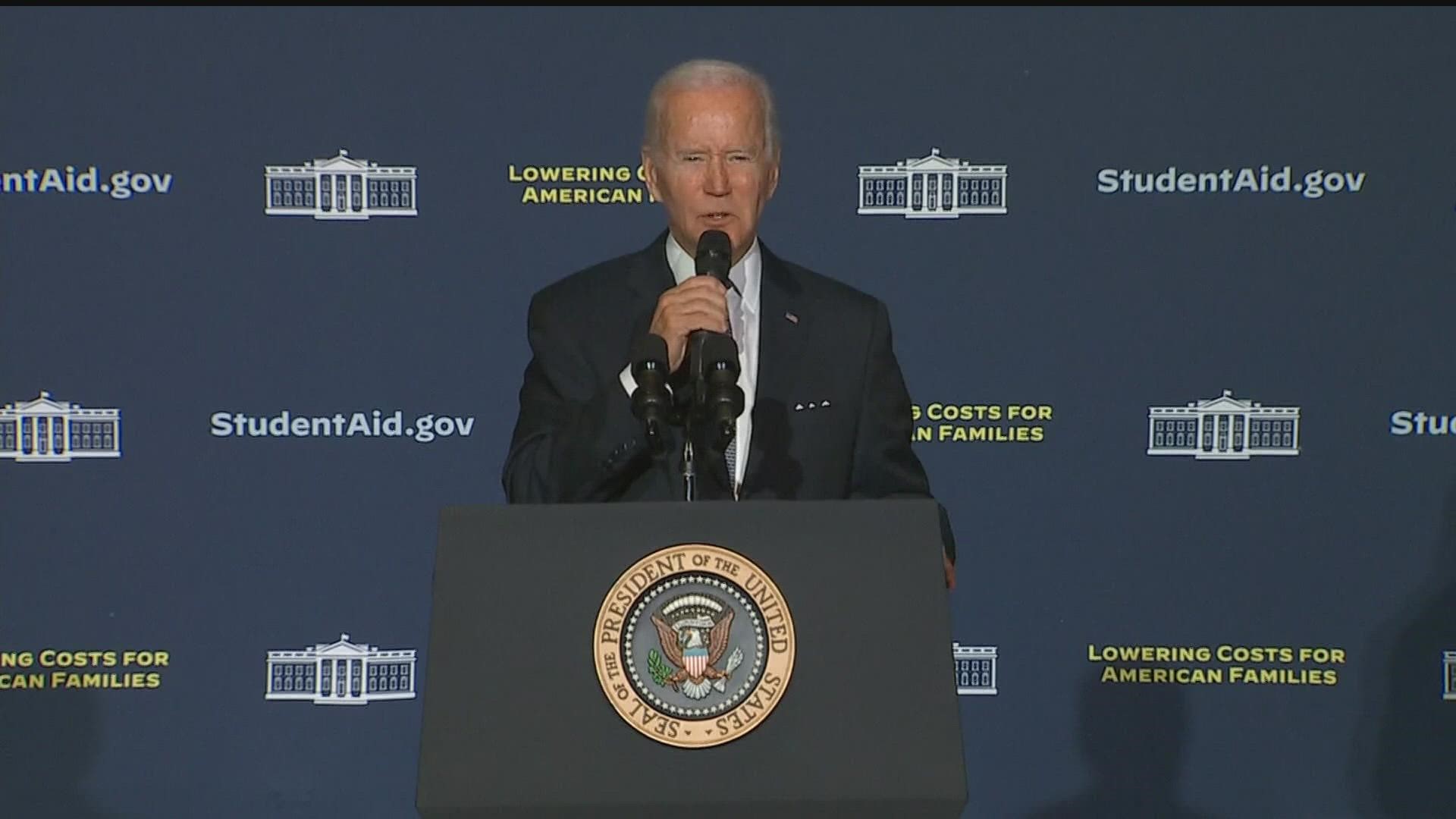

President Joe Biden announced in August that most federal student loan borrowers will be eligible for some forgiveness. 24 Biden announced that tens of millions of Americans would be eligible for student loan forgiveness. The income limits are based on your adjusted gross.

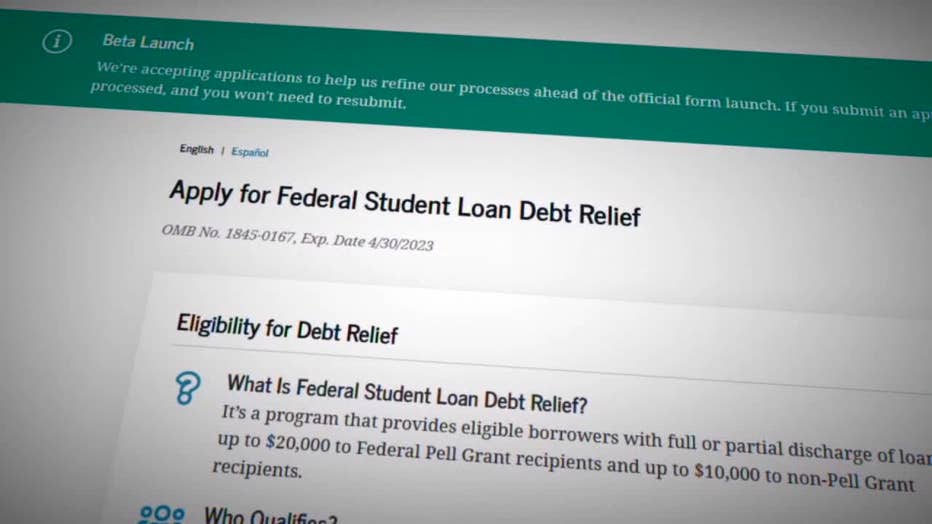

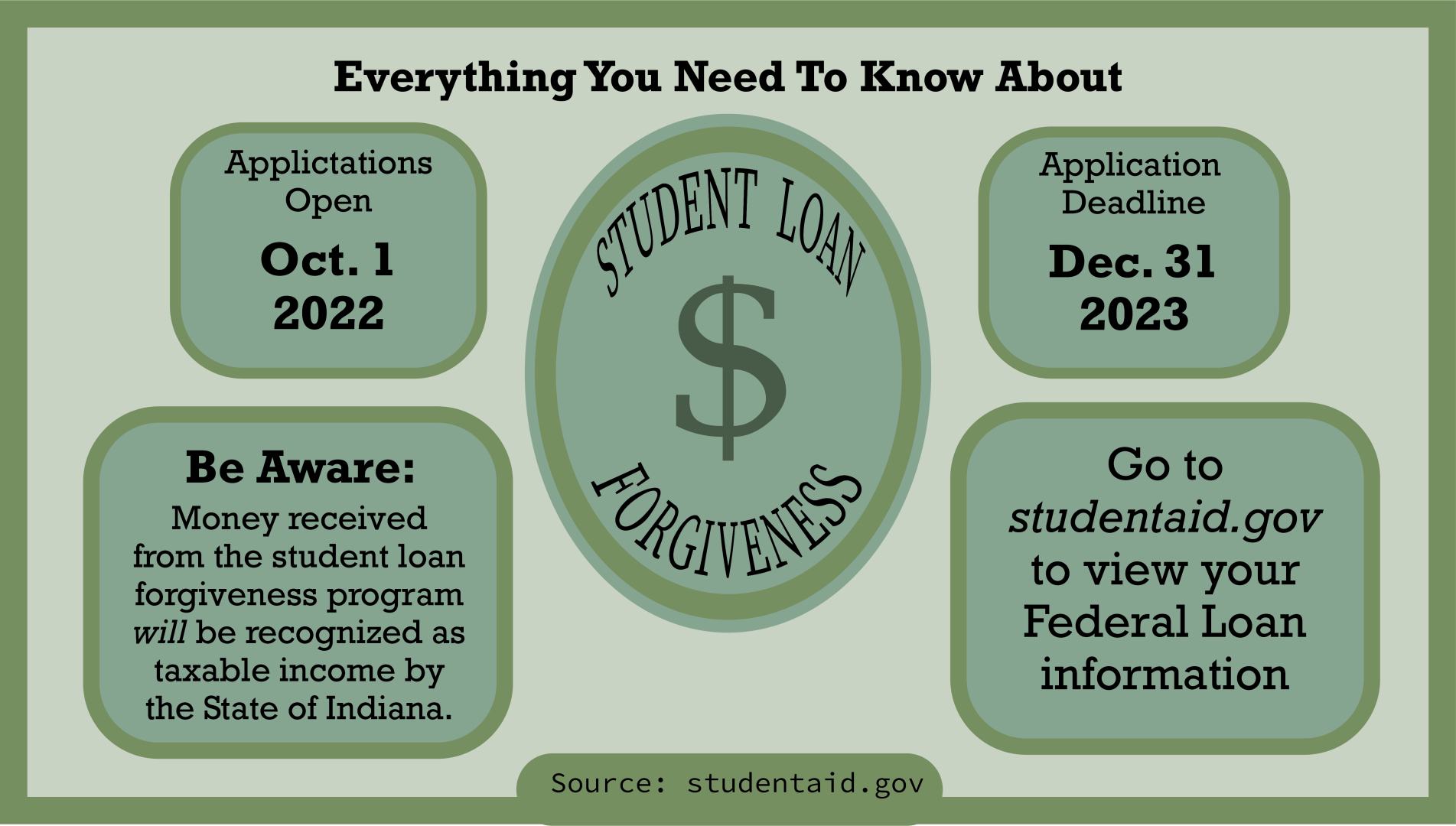

The federal student loan forgiveness program announced in late August was designed to move forward this year to enable many borrowers to see smaller monthly. Up to 10000 if they didnt receive a Pell Grant which is a. To qualify for this forgiveness program you must have federal student loans and meet specific income requirements.

Fulfilling a campaign pledge President Joe Biden announced in August plans to forgive up to 20000 in federal student loan debt for individuals with incomes below 125000. Student loan borrowers are now waiting indefinitely to see if theyll receive debt relief under President Joe Bidens student loan forgiveness program after a federal judge in. Bidens one-time debt cancellation initiative would have provided.

However the loan forgiveness element does not apply to private student loan borrowers who account for an estimated 8 of total outstanding student loan debt in the US. Nov 11 Reuters - The United States government has stopped taking applications for student debt relief after a federal judge blocked President Joe Bidens loan forgiveness plan. The Department of Education estimates that this.

Borrowers can qualify for debt forgiveness based on their income in either the 2020 or 2021 tax year. Student loan forgiveness income limits. The cutoff for married couples.

First off youll want to know that you can get up to 10000 in federal student loan forgiveness if your income is 125000 or less or 250000 or less per couple. The debt forgiveness plan announced in August would cancel 10000 in student loan debt for those making less than 125000 or households with less than 250000 in. By comparison Bidens student debt forgiveness program provides a maximum of 20000 in forgiveness if the person seeking relief received a federal Pell Grant and 10000 if.

Student Loan Forgiveness May Be Dead Here S What S Going On Los Angeles Times

Did You Hear About The Student Loan Announcements Scammers Did Too Consumer Advice

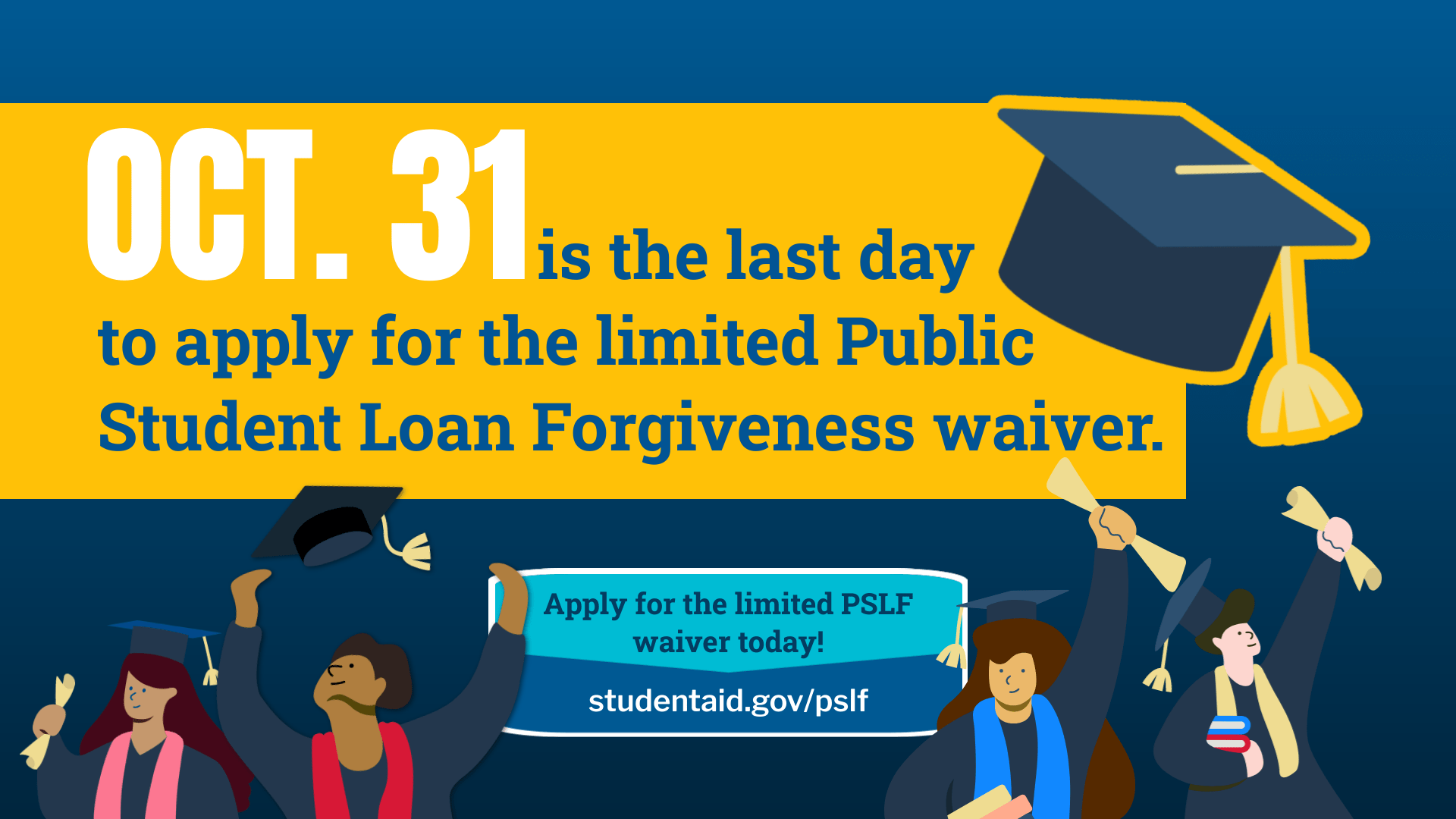

Don T Miss The Oct 31 Deadline For Student Loan Forgiveness

Loan Forgiveness How Student Debt In The U S Has Skyrocketed The New York Times

Public Service Loan Forgiveness Program Forbes Advisor

Application Form For 10 000 Student Loan Forgiveness Now Open Wcnc Com

Examining 3 Of The Arguments Of The Student Loan Forgiveness Debate Npr

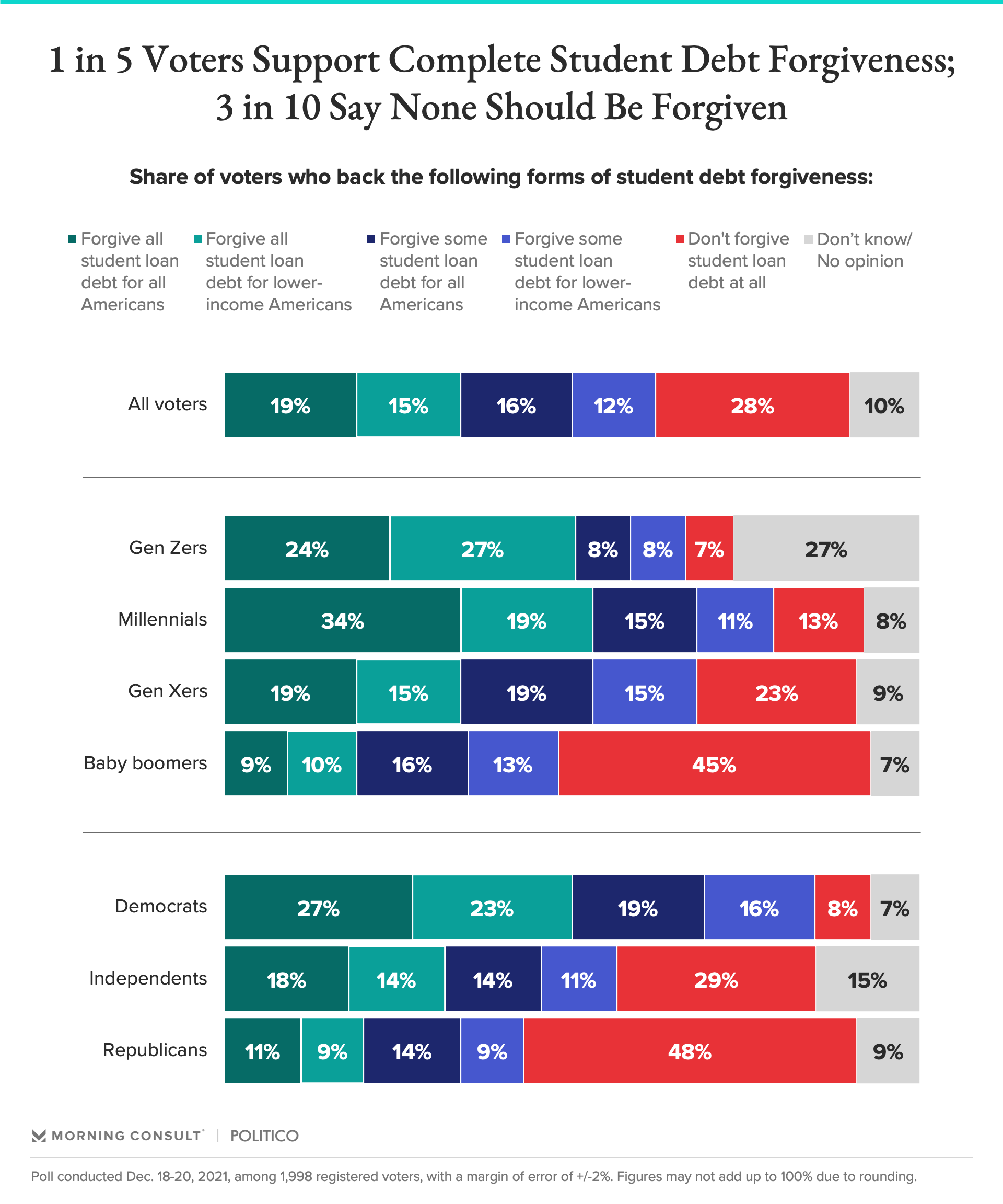

Millennial Voters Are Most Likely To Back Total Federal Student Loan Forgiveness

Student Loan Forgiveness Is Regressive Whether Measured By Income Education Or Wealth

Explainer Do You Qualify For Biden S Student Loan Forgiveness Plan

73 Of Americans Support Biden S Student Loan Forgiveness Plan

Millennial Voters Are Most Likely To Back Total Federal Student Loan Forgiveness

Joe Biden Could Have Gone A Lot Further On Student Loans Mr Online

Student Loan Forgiveness Applications Now Available Through Federal Student Aid Beta Launch

President Biden Announces Federal Student Loan Forgiveness Plan The Reflector